7 Ways to Make Money in a Crypto Bear Market: Full Analysis

|

Crypto markets can be volatile, and in a bear market, falling prices may seem like a nightmare. But there are ways to make money in a crypto bear market—and lots of them. Here's an analysis of seven unique strategies you can use to make money while the market downturns.

The 7 ways that you will read in this article are :

1. Trading Leverged Tokens 2. Staking Coins 3. Trade Perpetual Futures 4. Launchpads 5. DCA Strategy 6. Trading Bots 7. Copy Trading

What is a Bear Market?

A crypto bear market is a period of decline in the price of cryptocurrencies over a prolonged period. During this time, investors who had previously purchased digital currencies are likely to sell them off at a loss due to their lack of faith in the asset’s potential to increase in value.

How to Make Money in a Crypto Bear Market?

1. Trading Leveraged Tokens

What is Leveraged Tokens?

Leveraged tokens are based on

the value of an underlying currency, such as BTC, but they are not strictly a

currency themselves. Instead they are managed funds that multiply the profit or

loss by a set value. For example, if the price of BTC rises by 5% and you are

holding the BTC3L asset, your profit will be multiplied by 3,

and it will be like BTC went up by 15% instead.

On the other hand, if the price of BTC declines by 5% and you are holding

the BTC3S asset, your profit will be multiplied by 3,

since BTC3L : represent long positions and BTC3S :

represent short positions.

Unlike high risk divertivies trading as they are monitored constantly, there is

almost 0 risk of liquidation! There is only a small management fee of 0.1%,

taken from your position once per day.

On the downside, their value erodes over time when there is volatility on the

underlying asset. As such, they are suitable for short term

investments and will depreciate to almost 0 if held for a long time.

Where to Trade Leveraged Tokens?

The best place to trade

leveraged tokens is Bitrue Exchange where you can find

several tokens to choose from.

Steps

To Trade Leveraged Tokens on Bitrue Exchange

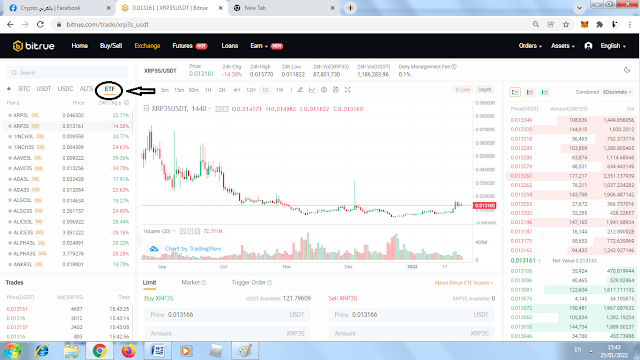

1. Go to Exchange button on the top corner.

2. Then

choose EFT on the left.

3. Choose the pair you want to trade.

Remember :

BTC3L: Is 3x long BTC. When

the price of the underlying asset increases by 1%, the net value of the product

will increase by 3%.

BTC3S: Short BTC 3x. When the underlying asset drops by 1%, the net

value of the product will increase by 3%. That's it , you're done !

How to Use Leveraged Tokens to Profit in Bear Market?

As stated above, when you choose any pair with ends in ( S ) , that means you open short position on this pair. That's also means, when the underlying asset drops, you get profits.

Let's take a real example:

The underlying asset BTC/USD daily

chart shows that the pair have dropped more than %12. However, when we look at

leveraged token BTC3S , the token has skyrocketed more than %50. The

token has rose from $0.054 to $0.090.

Thus, if you had bought BTC3S

in the above example, you would have been in profit.

|

|

2. Staking Coins

What is Staking ?

Staking is a process in which you use your coins to verify transactions on the network, as oppose to Hashing. However, Staking is now used to describe the process of holding coins in a wallet and collecting rewards according to how much you have. The more coins you have staked, the more rewards you receive, which can be used as an incentive for keeping your wallet open. And since this is an easy way to make money while doing nothing at all, many people choose this option as their primary source of passive income.

You can choose from many coins in the market to stake. Most wallets and

centralized exchanges offer Staking option for their customers.

However, even if you gain

rewards when you stake a coin in a bear market, there is a risk that your

coin plummets sharply, therefore , you will not notice your profit. You have to

wait the market to turn its course upward.

Because of that, we

recommend staking USDT or any stablecoin in bear market , because you avoid the

risk that your funds decrease in value.

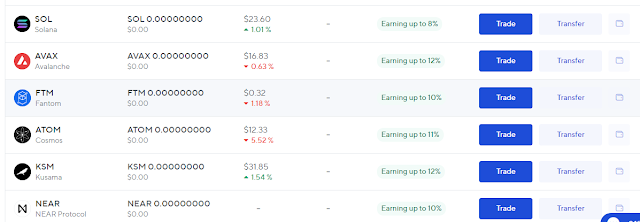

During bear markets, finding the right place to stake your coins can be tricky. Luckily, two of the best platforms for staking coins in a bear market are Nexo and Bitrue, both of which offer some of the highest annual percentage yields (APYs) on the market today.

In Nexo, you can stake BTC up to 7% APY , ETH 8% , XRP 8%, AVAX 12% and USDT 12% .

Register at NEXO Platform and Deposit $100 to Get $25 free in BTC

Alternatively, Bitrue exchange offer 7% APY for SOL , 8% MATIC , 12% ATOM, 15% NEAR and 7% DOGE. Also, you could choose many more tokens in their platform.

Don't forget that the platforms can change the annual percentage yields from time to time.

3. Trade Perpetual Futures

Futures trading is

very risky. We do not recommend it , because it can liquidate your funds. So

please use an amount of funds that you are willing to lose.

Unlike regular spot trading,

with perpetual contracts you can either buy long or sell short.

When you think there's going

to be a dip in the market, you take a 'short' or a 'sell' position; if you

think the market is going to go up, you take a 'long' or a 'buy' position.

Buying long means that you believe the value of the asset that you are buying is going to rise over time, and you will profit from this rise with your leverage acting as a multiple on this profit. Conversely, you will lose money if the asset falls in value, again multiplied by the leverage.

Buying short is the opposite - you believe that the value of this asset will fall over time. You will profit when the value falls, and lose money when the value increases.

Perpetual contracts allow you

to multiply the profits and losses on your positions through a system known as

leverage.

For example, if you

select a leverage multiple of 5x and the value of your underlying asset rises

by $1, you will make $1 * 5 = $5. On the contrary, if the underlying asset

falls by $1 you will lose $5.

So, in bear market just open

short positions to profit from declining market.

You can Trade Perpetual Future at Bybit and Earn $550 in Bonuses

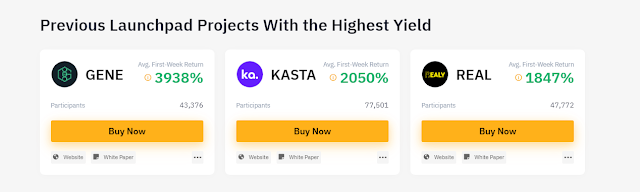

4. Launchpad

What is a launchpad?

A launchpad is a platform that provides users with access to pre-listing and token launches.

It allows users to

participate in groundbreaking blockchain projects, earn new tokens directly on

hosted launches, and gain early access to new project listings.

Just look at the Launchpad at Bybit Platform , and see how the huge returns people got from previous tokens launches. Some projects gave %3938 returns and other projects %2050 and %1847

How to Participate on Launchpads Projects?

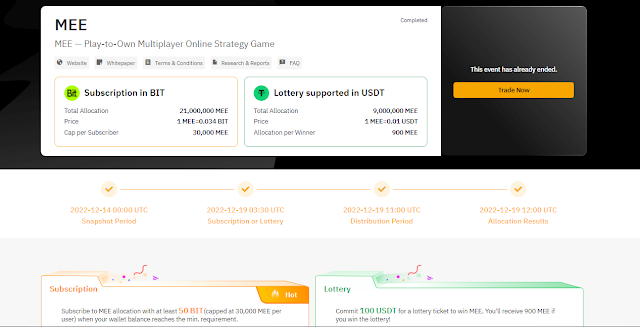

Although many exchanges provide Launchpad opportunities at their platforms, but we will take ByBit platform as an example.

In snapshot period ,you have to deposit at least 50 BIT token into your Bybit account ( You can buy BIT in Bybit platform ) . To calculate your daily average BIT balance, Bybit adds the total amount in your Spot Account, Earn Account and Derivatives Account throughout a day and divides it by 24 hours.

During the subscription period, you need to head over to the Bybit Launchpad and click the "Commit Now" button to commit a certain amount of BIT towards the new project.

During distribution period, and based on your final token allocation result, the corresponding BIT equivalent will be deducted from your committed amount, and the remaining BIT will be credited back to your spot account.

The exchange rate between BIT

and the new token will be confirmed 2 to 4 hours before the subscription period

starts.

5. DCA Strategy ( Auto-Invest )

The DCA (dollar-cost

averaging) strategy involves buying small amounts of crypto periodically

instead of buying a single, large order. This means that you are setting up

muments or smaller payments to buy cryptocurrency.

By doing this, you can spread out risks and increase your chances of getting

returns over the long term.

In addition to spreading out

your risk, DCA can also help you take advantage of price dips during a bear

market. Instead of buying a large amount of crypto all at one time, when the

prices go down, you will be able to buy more BTC with the same budget.

This averages out the cost of each coin and can be especially helpful if you believe that the markets will eventually recover or when trends indicate that buy signals are likely in the near future.

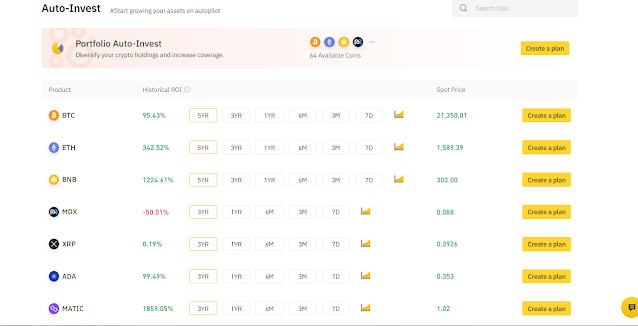

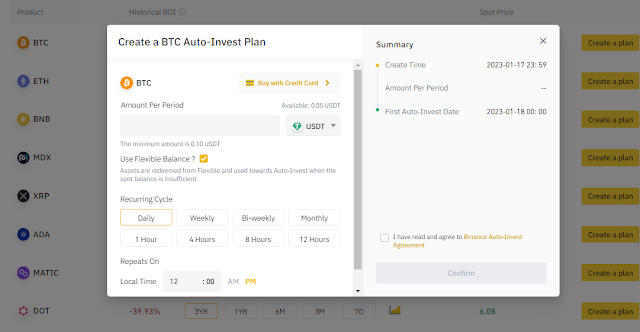

For those looking to adopt a DCA ( Dollar-cost average ) strategy, Binance provides an excellent Auto-Invest option. Head to the Auto-Invest page, where you can research the historical ROI of available coins.

After selecting the specific coin you want to invest in, click on Create a Plan icon. Here you can set the recurrent cycle for investing in the coin ( daily, weekly etc. ) along with specifying the amount you want to spend each cycle.

6. Trading Bots

A crypto trading bot is a

computer program that helps traders identify and capitalize on cryptocurrency

market trends. These automated programs can work 24 hours a day, seven days a

week to detect and execute buy and sell orders according to predetermined parameters

established by the trader.

Trading bots allow

crypto traders to benefit from price fluctuations without needing to be tied to

a computer or monitor markets around the clock.

However, traders will need programming knowledge to be able to use these

automated tools effectively. Fortunately, some cryptocurrency

exchanges allow users to copy trading bots from experienced members

so that they don't have to create their own.

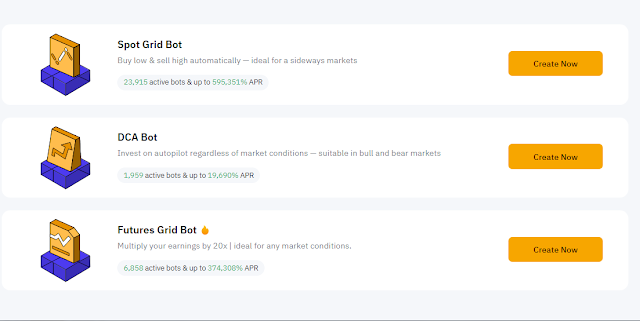

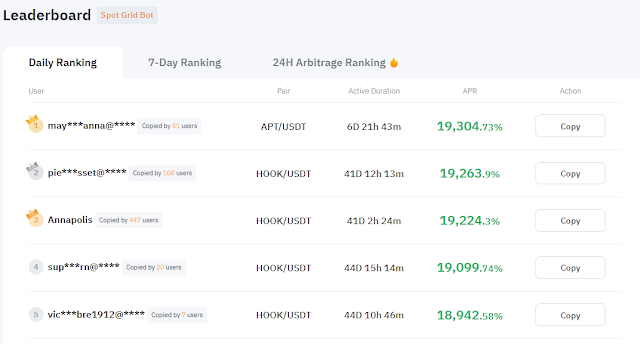

You can start trying Trading Bots in Bybit platform. Bybit offers a selection of different bot types, including spot grid bot, DCA grid and future grid bot.

On the Trading Bot page, you can check out the leaderboard of the best traders by APR and choose who to copy. All it takes is a few clicks, just select your desired investment amount and click Confirm.

7. Copy Trading

What is Copy Trading?

Copy trading is a type of trading strategy in which traders follow the

trading patterns and decisions of more experienced or successful traders. The term refers to automatically copying the trades that are made by another trader without having to manually enter each trade yourself.

Copy trading services help new traders learn the ropes of cryptocurrency trading while also allowing them to take advantage of the experience and success of more experienced traders.

In this way, it enables inexperienced investors to mitigate losses during market downturns by copying those who know how to navigate those difficult times more efficiently.

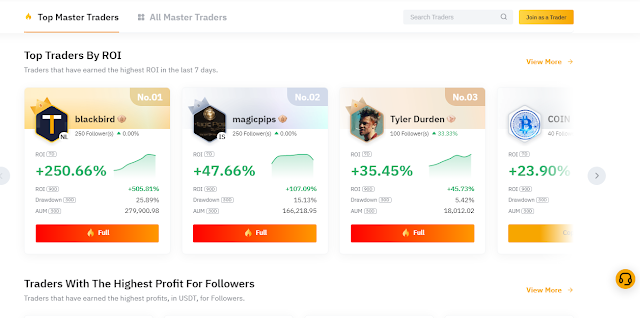

Looking to get started with copy trading on Bybit? First head to the Copy Trading page, where you can check out traders with highest ROI or those with highest profits for followers. Select the trader that best suits your needs and click 'Copy' - then you're ready to start!

.gif)

.jpeg)

Comments

Post a Comment