What is ApeX Pro DEX? Full Guide

By Deya Hroob

ApeX Pro: New Era for DEXs

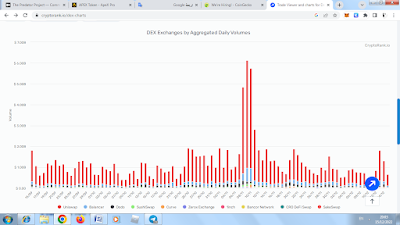

Interest in decentralized platforms DEXs has increased recently, due to the bankruptcy of a major platform FTX, which in turn affected investors confidence in CEXs platforms.

Trading volume at decentralized exchanges (DEXs) has already reached $109 billion in November across all chains.

The Difference between DEXs and CEXS Platforms?

CEXs stands for Centralized Exchanges like Bybit , Bitrue and Binance. While, DEXs stands for Decenralized Exchanges like Apex Pro , UniSwap and Bancor .

The investor's money in the CEXs platforms is under complete control of the platform, you have no control over your money. You are exposed to losing your money at any moment, as happened in FTX.

On decentralized exchanges, you have full control over your funds.

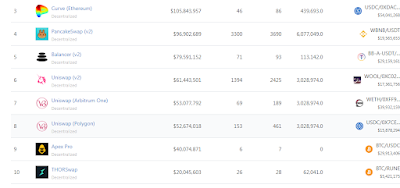

Centralized platforms have deep liquidity, compared to decentralized platforms.

Recently, however, some decentralized platforms like Apex Pro have begun to solve the liquidity problem using new technology. Also, When compared to centralized exchanges, decentralized platforms are secure.

ApeX Pro Platform DEX

Apex Pro platform is one of the newly emerging decentralized platforms in the market which is expected to gain a big market share among DEXs by trading volume in near future.

What is Apex Pro ?

ApeX Pro is a non-custodial trading platform that delivers limitless cross-margined perpetual contracts trading. It uses an order book modal. You can also have access to leverage up to 20x.

Apex Pro uses StarkEx to enhance the security of trading.

With the integration of StarkWare's Layer 2 scalability engine StarkEx and Validium, ApeX Pro offers cross-margined perpetual contracts with multi-chain support, low fees, deep liquidity and maximum security.

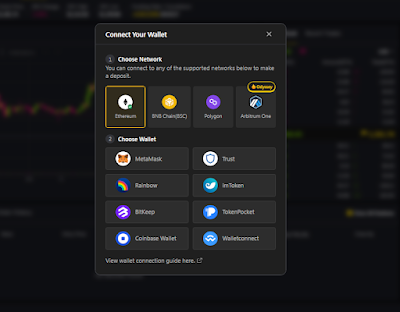

It supports 4 chains Arbitrum, Ethereum (ETH), Binance Chain (BNB), and Polygon (MATIC).

Why to Trade on ApeX Pro

· Trade to Earn Program in ApeX Pro

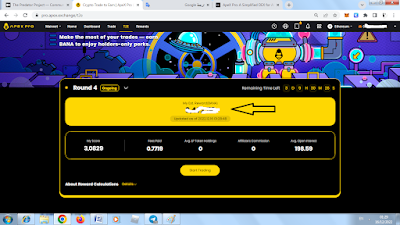

It is a 52 week- long program for platform clients, where users are rewarded for their trades. They are rewarded with BANA tokens. The rewards are distributed in a weekly basis.

All you have to do is trade. But of course, the higher your trading volume, the more $BANA rewards you’ll earn.

How to Participate on Trade to Earn Program

Simply, on the homepage of ApeX Pro platform, connect your wallet. ApeX Pro supports many different wallets like MetaMask, Trustwallet, Rainbow, BitKeep and many other choices.

After connecting your wallet , start trading as usual and you will automatically participate on the program.

To see how many BANA tokens you get , click on T2E page. You can see the token under My Estimated Rewards ( BANA ) for each round. Remember there are 52 rounds.

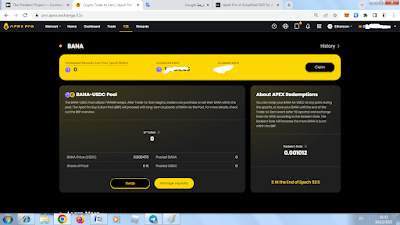

What is BANA Token?

BANA is a reward token distributed to participants of regular, weekly trade-to-earn events on ApeX Pro. You can read more about BANA here

You can use your BANA tokens by swapping them for USDC, or adding liquidity the to $BANA-USDC Pool to receive LP Tokens.

Finally, you can hold them to the end of the Trade to Earn Program, and redeem them for APEX token.

What is APEX Token?

It is APEX Protocol's own token. It is an ERC-20 token on Ethereum. It has a maximum and total supply of 1 billion.

It serves the following utilities:

(1) Governance - Token holders can submit and vote on protocol governance proposals.

(2) Protocol Incentivization - Users can earn ApeX tokens through participation rewards and liquidity mining on the ApeX protocol.

Where to Buy APEX Token?

You can buy APEX Token on ByBit platform and Uniswap.

· Bybit x ApeX Pro Integration

Recently, the well-known platform Bybit announced that they integrate ApeX Pro on Bybit Web3. The millions users of ByBit can now access to ApeX Pro through ByBit homepage.

This means that ApeX Pro will be available to millions of traders to trade on, making it one of the largest decentralized platforms in terms of trading volume in the future.

This will also be reflected in the higher value of the APEX token which is traded now at price of $0.38

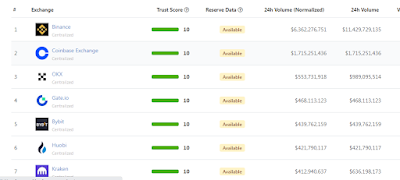

According to Coingecko , ByBit on the fifth place by trading volume.

.gif)

.jpeg)

Comments

Post a Comment