How, Where To Buy Dogecoin? Is it Worth it?

By Deya Hroob

What is Dogecoin?

Dogecoin was created by Billy Markus from Portland, Oregon and Jackson palmer from Sydney, Australia. It was officially launched om December 6, 2013. According to CoinMarketCap Dogecoin ranked 7 in the global crypto market cap.

Where To Buy Dogecoin?

In this post I will explain how to buy Dogecoin in Phemex exchange.

How to Buy Dogecoin?

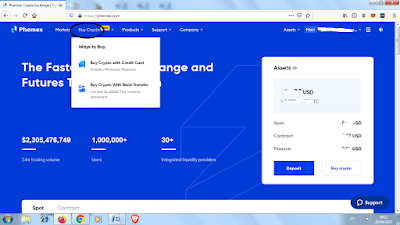

First, heads to Phemex exchange and click on Buy Crypto , then choose Buy Crypto with Credit Card.

Phemex works with well-trusted fiat-to-crypto gateway solution partners, sush as Banxa, Simplex, Moonpay, Coinify and Mercuryo.

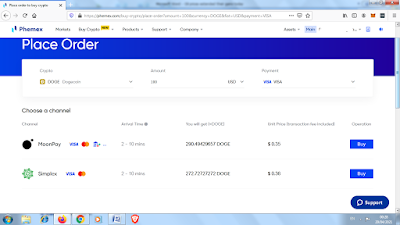

Secondly, in the payment details page , choose Dogecoin from the list and Enter the amount or quantity and choose a payment method. (You can choose between Visa , Mastercard or a Bank transfer) then click Buy Now.

Thirdly, in the Place Offer page , choose the best offer from different fiat-to-crypto gateways

As an example I choose Simplex offer and click Buy.

Finally, Proceed with your payment. Your Dogecoin will arrive in your account after the payment has been successfully completed.

Once you have purchased coins and hold them in your wallet you have a number of options. At Phemex we offer both Spot Trading and Contract Trading with up to 20x leverage.

Can you Buy Doge on Coinbase?

Unfortunately, Coinbase does not support purchases of Dogecoin.

What is the Best App to Buy Doge?

You can buy Doge from Crypto.com App using your credit card and get up to 8% cash back.

How, Where to Stake Doge?

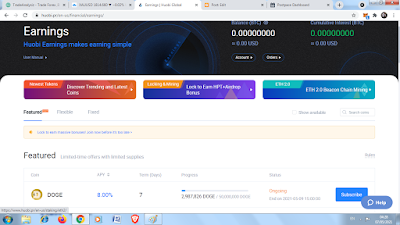

You can stake Doge on Huobi Exchange to enjoy up to 8% APY!

To start staking, go to Finance on the top, and then choose Earnings.

On the Earnings page, choose DOGE and click Subscribe. Define how many Doge you want to stake and you are all set.

Your Doge will be locked foe a week, and then you will get your interest in Doge.

.gif)

.jpeg)

Comments

Post a Comment